Porter’s Five Force Analysis

Helen Strong

Five Forces: Purpose

This model is one of the most popular management models to be used in strategic planning. It would be applied when the organization is trying to analyze the attractiveness of a market and inherent risks, through understanding which entities hold the power. The model helps to identify competitive threats either through increased competition, price manipulation, or control of resources.

Five Forces: Structure and Description

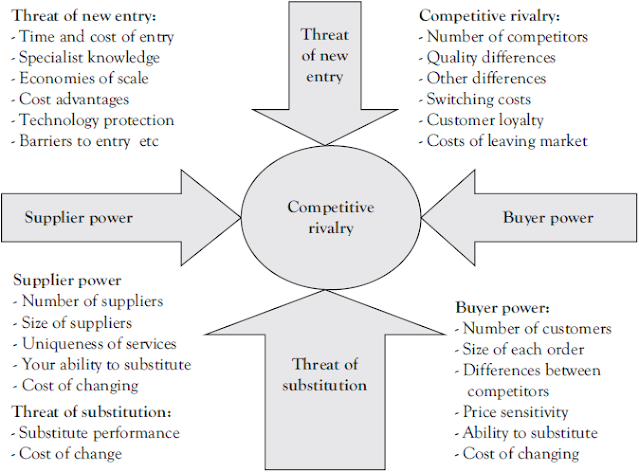

Essentially the five forces model (Figure 25.1) points your attention to the players in the market, requiring an assessment of their nature and capabilities. The underlying hypothesis is that business operations are a power play, and that the one who holds the controls, or who has the means to prevent other players from either entering or participating, is the one who will succeed.

The model is intended to evaluate the attractiveness of a market for participation and entry. Do bear in mind that it mainly helps you evaluate the macroenvironment. For a full picture of attractiveness, you would also consider conducting a marketing auditG on the microenvironment to check whether your product is aligned to market needs and preferences.

The graphic below from the Mindtools website raises some of the questions that need to be answered in order to use the model to evaluate the situation and risks associated with your marketplace.

Whilst the model includes the customer or buyers, a lot more emphasis is placed on the environment and factors affecting organizations manufacturing, supplying products, or both, rather than on the target market.

Figure 25.1 Porter’s five forces

Source: Reproduced by permission from Mindtools.com (n.d.).

Five Forces: Strategic Considerations

The model has tipped the scales at the top of the popularity polls since it was first released by Porter in 1979. If it is properly applied, the C-suite team has a comprehensive picture of the trends and risks in the market. Whilst the organizational vision may remain constant, it is possible to adjust the organization’s objectives and strategies to take account of the changing conditions in the market.

Decisions are based on the facts that have been gathered and analyzed. There is a conscious effort to understand the factors behind the trends. This deliberate unraveling and reintegration of the forces in the market enable the team to make decisions with insight into the risks and benefits of being in the chosen markets or segments.

Five Forces: Implementation

Competitive Rivalry

The expected degree of rivalry could be in proportion to the number of consumers in the target market, the number of companies operating in a market, and the ability of those companies to differentiate their products according to the consumer needs and wants; see Market Structures in Chapter 35.

To apply the five forces model and understand the risks faced by your organization, you need to have information about:

- The number of competitors, their structure, and geographical presence

- How the industry functions?

- What are the macrotrends affecting this industry? For example, the green movement

- Legislation and regulations affecting operations

- Understand the quality standards required by the market and how they are matched by you and your competition

- What are the key drivers and success factors in this industry?

- Identify using the Pareto principle the 20 percent of companies doing 80 percent of the business

- Identify their strategies, know their product ranges, and their other marketing mix factors

- Appreciate their research and development activity. How innovative are they?

- Finally, analyze how they are different to you. What markets do they serve? How are their products better than or not as good as yours?

- How strong is their brand? What image do they have?

- What do consumers like about them and their services? And how do you stack up in this assessment?

With this type of information, you are in a position to know which companies need to be on your radar. You will know which can be included or ignored in strengths, weaknesses, opportunities, and threats (SWOT) analyses in the future.

Buyer Power

It is totally possible for buyers to flex their muscles and influence the way in which the market operates. For example, in South Africa for a long time mining houses dictated terms to their suppliers. In the retail sector in South Africa, we have seen the likes of Woolworths and Pick ‘n Pay dictate delivery and pricing terms to their suppliers. To gain a listing, and the associated turnover, suppliers to these buyers go out of their way to meet the terms. In spite of the Competition Commission, these practices are still rife in our economy.

How can buyers gain their power?

First, if a buyer holds an enormous share of purchases, they will exercise a disproportionate influence on what they are prepared to pay. In this way, they protect their margins. They will also delay supplier payment to 90 or 120 days, putting smaller suppliers at risk of going out of business. Often they have a choice as to what they will buy, dictating, in a way what is made available to the final consumers.

When the balance of power could be in the hands of the buyers, you need to factor in lower prices and late payments into the cost. You need to calculate what these practices will do to your margins. The ultimate question is: Can you afford to do business with this type of customer?

Threat of Substitution

In the marketplace, you need to be aware of which products offer similar or better benefits than yoursG. This tied to the user’s buying criteria will inform you of the risk your products face of substitution. Protection can be found in the form of some unique feature of your product that is valued by the consumer. This differentiation is extremely difficult to achieve in view of all the modern manufacturing processes.

Where companies are often caught short is where they do not see the emergence of substitution products or services from what we could call nontraditional sources. For example, retailers now compete with banks for deposits by enabling payment of municipal bills through their tills. It is convenient for customers, but removes a substantial amount of business out of the traditional banking system.

It is hence incumbent on marketers and researchers to keep in touch with trends, to monitor innovation companies and websites. Consumers may express needs that are noticed and taken up by totally different industries. Companies also need to be alert to think out of the box, applying their own products and technologies across industry borders.

Supplier Power

Suppliers of specialist products and custom-made items are in a position to dictate their own terms. There are likely to be only a few who can meet stringent quality specifications, and they will have skilled personnel, advanced technology, or both, which needs to be rewarded.

Where relationships have been built up over time, it is also more difficult to change suppliers. The incumbents know your needs and are comfortable with your systems. Where change is instituted then there are likely to be errors and hitches that people do not want to have to deal with.

To level out the balance of power, a company need to conduct performance reviews at regular intervals so that suppliers’ service quality and levels can be monitored (and not allowed to deteriorate, even if they are preferred suppliers).

Here the researcher needs to know what levels are expected in contracts, and what the consequences are if those standards are not met.

Threat of New Entries

Many industries are protected via entry barriers being prohibitive. To minimize surprises from this factor, companies again need to be aware of trends and events within their industry. Which companies are gaining market share, which are losing, and are these companies likely to exit the market leaving space for another more imposing competitor.

As we mentioned in the section on substitution, new players can emerge from anywhere, so keeping in touch with the broader environment is important to be aware of what is happening throughout the business world, and who is changing strategies or technology or both. Monitor university theses and research projects. Maybe hidden amongst the many submissions is the next threat to your company and its products.

Five Forces: Conclusions

To be attractive, the risks that emerge from the analysis need to be manageable, and profit margins achievable within the parameters set by the organization. Ideally one would want a market where:

- The threat of substitutes is low, that is, the product offering fulfills a particular need or want and there is a limited choice of alternatives.

- Competitive activity is at a level that still allows a company to achieve a respectable market share, without having to do too much promotion and discounting to maintain that share.

- The threat of new entrants is minimal, preferably coupled with a sustainable advantage or differentiation enjoyed by the organization.

- There are sufficient suppliers of raw materials, equipment, and technology to prevent manipulation of the market price and supply, that is, to give the organization a choice of suppliers.

- The buyers in a market are not able to organize themselves into pressure groups to influence the price and margins in the product (or function) category.

References

Ahonen, T.T. 2013. “Around the World With Mobile: Global Insights and Regional Relevance of Mobile Marketing.” Presented at MMA Forum: Mobile’s Role in the Path to Purchase, New York, May 8 – 10. New York: Mobile Marketing Association. Available from: http://www.slideshare.net/vivastream/around-the-world-with-mobile-global-insights-and-regional-relevance-of-mobile-marketing-20847876

Bae, Y.H. 2012. Three Essays on the Customer Satisfaction–Customer Loyalty Association http://ir.uiowa.edu/etd/3255 (accessed July 3, 2013).

Barron, P. 2013. Force Field Analysis http://www.change-management-consultant.com/force-field-analysis.html (accessed October 22, 2013).

Bernstein, D. 2011. Value Proposition: A Free Worksheet to Help You Win Arguments in Any Meeting http://www.marketingexperiments.com/blog/general/value-proposition-worksheet.html (accessed July 10, 2013).

Boston Consulting Group. 1973. “The Experience Curve–Reviewed IV.” The Growth Share Matrix or The Product Portfolio, http://www.bcg.com/documents/file13904.pdf (accessed May 25, 2014).

Clayton Christensen Institute. 2012. Disruptive Innovation, http://www.christenseninstitute.org/key-concepts/disruptive-innovation-2/ (accessed July 17, 2013).

Content Marketing Institute, 2011, What is Content Marketing?, Cleveland,

Z Squared Media LLC. Available from: http://contentmarketinginstitute.com/what-is-content-marketing/ (accessed May 19, 2014).

Eslkevin’s Blog. May 16, 2013. Hofstede’s Cultural Dimensions Theory, http://eslkevin.wordpress.com/2013/05/16/hofstedes-cultural-dimensions-theory/ (accessed September 9, 2013).

Fleishman-Hillard and Lepere Analytics. 2013. The Authenticity Gap: Managing Expectations and Experience, http://fleishmanhillard.com/wp-content/uploads/meta/resource-file/2013/authenticity-gap-executive-summary-1367433000.pdf (accessed September 16, 2013).

Fu, B.; and T.P. Labuza. 2000. Shelf Life Testing: Procedures and Prediction Methods for Frozen Foods. St Paul, MN: University of Minnesota. http://www.google.co.za/url?sa=t&rct=j&q=&esrc=s&source=web&cd=6&cad=rja&ved=0CEYQFjAF&url=http%3A%2F%2Fwww.researchgate.net%2Fpublication%2F2402471_Shelf_Life_Testing_Procedures_and_Prediction_Methods_for_Frozen_Foods%2Ffile%2F9fcfd50ca4182953af.pdf&ei=G6rSUpTEIOHL0QW6wYGIBA&usg=AFQjCNF8mnmqOlASQwMO3-i2K_dcOMaEsA&bvm=bv.59026428,d.bGQ (accessed January 12, 2014).

Greenberg, M. 2009. Do the Math: An Easy Formula to Forecast Customer Growth, http://venturebeat.com/2009/08/25/do-the-math-an-easy-formula-to-forecast-customer-growth/ (accessed August 18, 2013).

Gunelius, S. 2011. Brand Equity Basics – Part 1: What Is Brand Equity?, http://aytm.com/blog/research-junction/brand-equity-basics-1/ (accessed June 3, 2013).

Jarvis, B. n.d. Conjoint Analysis 101, http://www.pragmaticmarketing.com//resources/conjoint-analysis-101?p=0 (accessed August 18, 2013).

Johnston, J. 2012. How Volvo Construction Uses Digital Marketing to Fuel Sales, http://www.marketingsherpa.com/video/volvo-digital-marketing-fuel-sales (accessed August 20, 2013).

Keaveney, S. April 1995. “Customer Switching Behavior in Service Industries: An Exploratory Study.” Journal of Marketing 56, no. 2, pp. 71–82.

Keller, K.L. 1999. Blending Branding Theory & Practice: Insights & Lessons from Applying the Brand Resonance Model, http://www.docstoc.com/docs/108016293/BLENDING-BRANDING-THEORY-and-PRACTICE (accessed May 25, 2014).

Keller, K.L. 2006. “Measuring Brand Equity.” The Handbook of Marketing Research: Uses, Misuses, and Future Advances, eds. R. Grover; and M. Vriens. Thousand Oaks, CA: Sage publication.

Keller, K.L. 2010. The New Branding Imperatives: Insights for the New Marketing Realities, http://exec.tuck.dartmouth.edu/downloads/350/msi_ff_10-700.pdf

(accessed June 3, 2013).

King, D. 2005. Ge 1300. Introduction To Human Geography Lecture 15. Location of Industry, http://www.csiss.org/classics/archive/lect15.htm (accessed September 12, 2013).

Kirby, J. 2013. A Unique Approach to Marketing Coca-Cola in Hong Kong, http://blogs.hbr.org/hbr/hbreditors/2013/02/a_unique_approach_to_marketing_coca_cola_in_hong_kong.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+harvardbusiness+%28HBR.org%29 (accessed July 15, 2013).

Klepper, S. 1997. “Industry Life Cycles.” Industrial and Corporate Change, Vol 6, No. 1, pp. 145–180.

Kotler, P. 2000. Marketing Management, Millennium Edition. Upper Saddle River, NJ: Prentice-Hall, Inc.

Kugytė, R.; and L. Šliburytė. 2005. “A Standardized Model of Service Provider Selection Criteria for Different Service Types: A Consumer-Oriented Approach.” ISSN 1392-2785 Engineering Economics 43, no. 3.

Kussmaul, M. 2012. Marketing: The Four P’s or the Four C’s, http://www.marketplacemotivations.com/articles/magazine-articles/54-marketing-the-four-p-s-or-the-four-c-s (accessed September 9, 2013).

Lasswell, M. 2004. Lost in Translation Time and Again, Product Names in Foreign Lands Have Come Back to Haunt Even the Most Brilliant of Marketers, http://money.cnn.com/magazines/business2/business2_archive/2004/08/

01/377394/ (accessed September 9, 2013).

Levitt, T. July–August. 1960. “Marketing Myopia.” Harvard Business Review 38, no. 4, pp. 45–56.

McClaren, D. 2013. Nike Takes Gamification to the Next Level with Nike Fuel Missions, http://www.theuksportsnetwork.com/nike-takes-gamification-to-the-next-level-with-nikefuel-missions (accessed July 15, 2013).

McSweeney, B. 2002. Hofstede’s Model of National Cultural Differences and Their Consequences: A Triumph of Faith – a Failure of Analysis, http://www.uk.sagepub.com/managingandorganizations/downloads/Online%20articles/ch05/4%20-%20McSweeney.pdf (accessed September 6, 2013).

MindTools.com. n.d. a. Porter’s Five Forces Assessing the Balance of Power in a Business Situation, http://www.mindtools.com/pages/article/newTMC_08.htm (accessed December 31, 2013).

MindTools.com. n.d. b. Cost-Benefit Analysis, http://www.mindtools.com/pages/article/newTED_08.htm (accessed January 6, 2014).

MSG. n.d. Brand Equity – Meaning and Measuring Brand Equity, http://www.managementstudyguide.com/brand-equity.htm (accessed June 3, 2013).

Mullins, J. 2013. The New Business Road Test: What Entrepreneurs and Executives Should do Before Launching a Lean Start-Up. London: FT Publishing.

Nichols, W. March 2013. “Advertising Analytics 2.0.” Harvard Business Review, 91, no. 3, pp. 60–68.

Olenski, S. 2012. The Engagement Marketing Disconnect Between Consumers and Brands Rages On, http://www.forbes.com/sites/marketshare/2012/11/26/the-engagement-marketing-disconnect-between-consumers-and-brands-rages-on/ (accessed August 19, 2013).

Palmer, D.; S. Lunceford; and A.J. Patton. 2012. The Engagement Economy: How Gamification Is Reshaping Businesses, http://dupress.com/articles/the-engagement-economy-how-gamification-is-reshaping-businesses/ (accessed July 10, 2013).

Parasuraman, A.; V. Zeithaml; and L. Berry. Fall 1985. “A Conceptual Model of Service Quality and Its Implications for Future Research.” Journal of Marketing 49, no. 4, pp. 41–50.

Parnitzke, J. 2013. How to Build a Roadmap – Gap Analysis, http://pragmaticarchitect.wordpress.com/2013/06/11/how-to-build-a-roadmap-gap-analysis/ (accessed August 20, 2013).

Pearson Education. 2013. Culture: The Nature of Culture, http://www.infoplease.com/encyclopedia/society/culture-the-nature-culture.html (accessed September 6, 2013).

Perner, L. 2013. Segmentation, Targeting and Positioning, http://www.consumerpsychologist.com/cb_Segmentation.html (accessed October 7, 2013).

Personal.psu.edu. 2001. Roger’s Diffusion of Innovations, http://www.personal.psu.edu/users/w/x/wxh139/Rogers.htm (accessed October 9, 2013).

Point of Purchase Advertising International (POPAI). 2012. 2012 Shopper Engagement Study Media Topline Report. Chicago: The Global Association for Marketing at Retail, http://www.popai.fr/textes/Shopper_Engagement_Study.pdf (accessed March 11, 2014).

Pulse Group PLC. 2009. Consumer Brand Loyalty in a Recession Final, http://www.slideshare.net/bobchua/consumer-brand-loyalty-in-a-recession-final (accessed August 18, 2013).

Rogers, E.M. 1995. Diffusion of Innovations. 4th ed. New York, NY: The Free Press.

Ryan, M.; A. Sleigh; K.W. Soh; and Z. Li. 2013. Why Gamification is Serious Business, http://www.accenture.com/us-en/outlook/Pages/outlook-journal-2013-why-gamification-is-serious-business.aspx (accessed July 10, 2013).

Sawtooth Software. n.d. What is Conjoint Analysis?, http://www.sawtoothsoftware.com/products/conjoint-choice-analysis/conjoint-analysis-software (accessed August 22, 2013).

Sawtooth Technologies. n.d. Perceptual Mapping, http://www.sawtooth.com/index.php/consulting/overview/perceptual-mapping (accessed August 22, 2013).

Shipham, S.O. 2010. “The MBA Research Process: Some Theoretical Considerations.” Management Today 28, no. 6, pp. 49–50.

Silverman, G. 2000. What to Do When Quantitative and Qualitative Research Contradict Each Other, http://www.quirks.com/articles/a2000/20001201.aspx?searchID=808886082&sort=9 (accessed September 10, 2013).

Smith, P.R. 2011. SOSTAC® Guide to Writing The Perfect Plan, www.prsmith.org; www.facebook.com/prsmithmarketing

Sorenson, L. 2011. 6 Core Benefits of Well-Defined Marketing Personas, http://blog.hubspot.com/blog/tabid/6307/bid/29583/6-Core-Benefits-of-Well-Defined-Marketing-Personas.aspx (accessed September 9, 2013).

Stevens, G. n.d. Product Lifecycle | Do You Know Where Your Business Is?, http://www.beasuccessfulentrepreneur.com/product-lifecycle-do-you-know-where-your-business-is/ (accessed December 31, 2013).

Stinson, J.E.; and W.A. Day. 1990. Developing Competitive Strategy, http://www.ouwb.ohiou.edu/stinson/Developing Strategy.html (accessed July 22, 2013).

Sunshine, J. 2012. 11 Brand Names That Sound Hilarious in a Different Language, http://www.huffingtonpost.com/2012/08/10/lost-in-translation-brands_n_1765812.html#slide=1362544 (accessed December 30, 2013).

Thomas, J.W. 1993. Product Testing, http://www.decisionanalyst.com/publ_art/prodtes1.dai (accessed July 10, 2013).

Thompson, R. n.d. Stakeholder Analysis: Winning Support for Your Projects, http://www.mindtools.com/pages/article/newPPM_07.htm (accessed August 20, 2013).

Wartzman, R. 2009. Authentic Engagement, Truly, http://www.businessweek.com/managing/content/dec2009/ca2009123_747440.htm (accessed October 7, 2013).

Wikimedia Commons. 2007. File:Servqual NL.gif, http://commons.wikimedia.org/wiki/File:Servqual_NL.gif?uselang=en-gb# (accessed January 7, 2014).

Wikipedia. 2012 a. Brand Equity, http://en.wikipedia.org/wiki/Brand_equity (accessed September 12, 2013).

Wikipedia. 2012 b. Ishikawa Diagram, http://en.wikipedia.org/wiki/Ishikawa_diagram (accessed October 7, 2013).

Wong, K.C. 2011. Using an Ishikawa Diagram as a Tool to Assist Memory and Retrieval of Relevant Medical Cases from the Medical Literature, http://www.jmedicalcasereports.com/content/5/1/120 (accessed October 9, 2013).

Zhang, K.Z.K.; C.M.K. Cheung; and M.K.O. Lee. 2012. “Online Service Switching Behavior: The Case of Blog Service Providers.” Journal of Electronic Commerce Research 13, no. 3, http://www.csulb.edu/journals/jecr/issues/20123/paper1.pdf (accessed January 20, 2014).

Zimmermann, A.; and C. Maennling. 2007. Mainstreaming Participation, http://www.fsnnetwork.org/sites/default/files/en-svmp-instrumente-akteuersanalyse.pdf (accessed October 13, 2013).

Additional Sources

Ballou, R.H. 2006. The Evolution and Future of Logistics and Supply Chain Management, http://www.scielo.br/scielo.php?script=sci_arttext&pid=S0103-65132006000300002&lng=en&nrm=iso (accessed September 12, 2013).

Chronostrategy. n.d. ADL Matrix, http://chronostrategy.wikispaces.com/ADL+Matrix (accessed January 5, 2014).

Fruin, M. 2013. Competitive Strategy and Industry Environment, www.cob.sjsu.edu/fruin_m/Spring2013/ppt/chapter6.ppt (accessed July 20, 2013).

Gartner, Inc. 2011. Gartner Predicts Over 70 Percent of Global 2000 Organisations Will Have at Least One Gamified Application by 2014, http://www.gartner.com/newsroom/id/1844115 (accessed July 15, 2013).

Gurel-Atay, E.; G.-X. Xie; J. Chen; and L.R. Kahle. March 2010. “Changes in Social Values in the United States: 1976-2007 ‘Self-Respect’ Is on the Upswing as ‘A Sense of Belonging’ Becomes Less Important.” Journal of Advertising Research 50, no. 1, pp. 57–67.

Harquail, C.V. 2009. 7 Core Principles for Authentic Engagement, http://authenticorganizations.com/harquail/2009/05/11/7-core-principles-for-authentic-engagement/ (accessed October 6, 2013).

Hugos, M.H. 2011. Essentials of Supply Chain Management, 3rd ed. New York, NY: Wiley.

Kirkpatrick, D. 2011. B2B Gamification: Bold Strategy in Conservative Industry Increased Website Visits 108.5%, http://www.marketingsherpa.com/article/case-study/bold-strategy-in-conservative-industry (accessed July 16, 2013).

Kirkpatrick, D. 2012. Gamification: 6 Tactics for B2B Marketers, http://www.marketingsherpa.com/article/how-to/6-tactics-b2b-marketers (accessed July 10, 2013).

Lee, M. 2007. Book Summary: Crossing the Chasm by Geoffrey Moore, http://bizthoughts.mikelee.org/book-summary-crossing-the-chasm.html (accessed July 23, 2013).

Mullins, J. 2010 a. Markets and Industries: What’s the Difference and Why Does it Matter?, http://www.europeanbusinessreview.com/?p=2366 (accessed August 20, 2013).

Mullins, J. 2010 b. The New Business Road Test: What Entrepreneurs and Executives Should Do Before Writing a Business Plan. 3rd ed. London: Prentice Hall.

ODI. 2009. Planning Tools: Stakeholder Analysis, http://www.odi.org.uk/publications/5257-stakeholder-analysis (accessed August 20, 2013).

Olsen, Z. 2013. Product Adoption Curve Marketing, http://www.bydatabedriven.com/product-adoption-curve-marketing/ (accessed July 19, 2013).

Pressley, M.M. 2008. “Chapter 7: Competitive Strategy and the Industry Environment.” http://college.hmco.com/hjinstruct/powerpt/ch07/sld001.htm (accessed July 22, 2013). (Taken from Hill, C.W.L.; and G.R. Jones. 2008. Strategic Management: An Integrated Approach. Houghton Mifflin Company.)

Saltlane. 2009. Stakeholder Analysis http://www.saltlane.co.uk/Resources/stakeholder%20analysis.HTML (accessed August 20, 2013).

SCOR. 2013. What is SCOR?, http://supply-chain.org/scor (accessed September 15, 2013).

See also: www.newbusinessroadtest.com; www.johnwmullins.com

Supply Chain Management Institute. 2008. The Supply Chain Management Process, http://www.ijlm.org/Our-Relationship-Based-Business-Model.htm (accessed September 9, 2013). (The diagram comes from the book Lambert, D.M. 2008. Supply Chain Management: Processes, Partnerships, Performance, 3rd ed. Ponte Vedra Beach, FL: Supply Chain Management Institute .)

Toy, T. 2013. How To Develop a Killer Marketing Plan, Methods Used, General Rules, Six Key Steps, Business Models And Samples, http://tommytoy.typepad.com/tommy-toy-pbt-consultin/2013/04/how-to-develop-a-killer-marketing-plan-methods-used-general-rules-six-key-steps-business-models-and-samples.html (accessed August 23, 2013).

Walker, D.; A. Shelly; and L. Bourne. 2008. Influence, Stakeholder Mapping and Visualization, www.researchgate.net/publication/24078124_Influence_stakeholder_mapping_and_visualization/file/d912f (accessed August 20, 2013).

Wikipedia. 2013. Hofstede’s Cultural Dimensions Theory, http://en.wikipedia.org/wiki/Hofstede%27s_cultural_dimensions_theory (accessed September 2, 2013).

Willcocks, L.P.; S. Cullin; and M.C. Lacity. 2007. The Outsourcing Enterprise The CEO Guide to Selecting Effective Suppliers, http://www.outsourcingunit.org/publications/Selecting_Effective_Suppliers.pdf (accessed September 15, 2013).